Go to your individual IRS account to verify the total of your three stimulus money by clicking "economic impact payment information". In case you receive the Need More Information message, the IRS needs more details about your tax returns to send your rebate online. If you received a message establishing that your payment status isn't available, you could claim the "recovery rebate credit" by filling out the worksheet to check if you are eligible. They should create an online account on the IRS Pay section or refer to IRS Notice 1444-C to find the amount owed by the IRS. You can see if your payment has already been received by using the link below. The new tool created by the IRS works this way: Create an Online accountĪccording to the IRS, taxpayers will no longer use the Get My Payment app to check their payment status. Those whose information is on file with the IRS for tax information will receive the money via direct deposit. On September 30, the IRS commented that almos t 6 million individual returns were waiting to be processed. How does the tool work?Īccording to the IRS, you can expect a processed tax return within 21 days of filing online or from six to eight weeks if you send everything via mail. If you accidentally entered a typo, the wrong address or a. As a taxpayer, you have a high possibility of receiving your money after the established date. The simplest reason the IRS might not be able to match you with your stimulus payment status could come down to your keyboard. On the next page, you will see a notification message about authorized use.

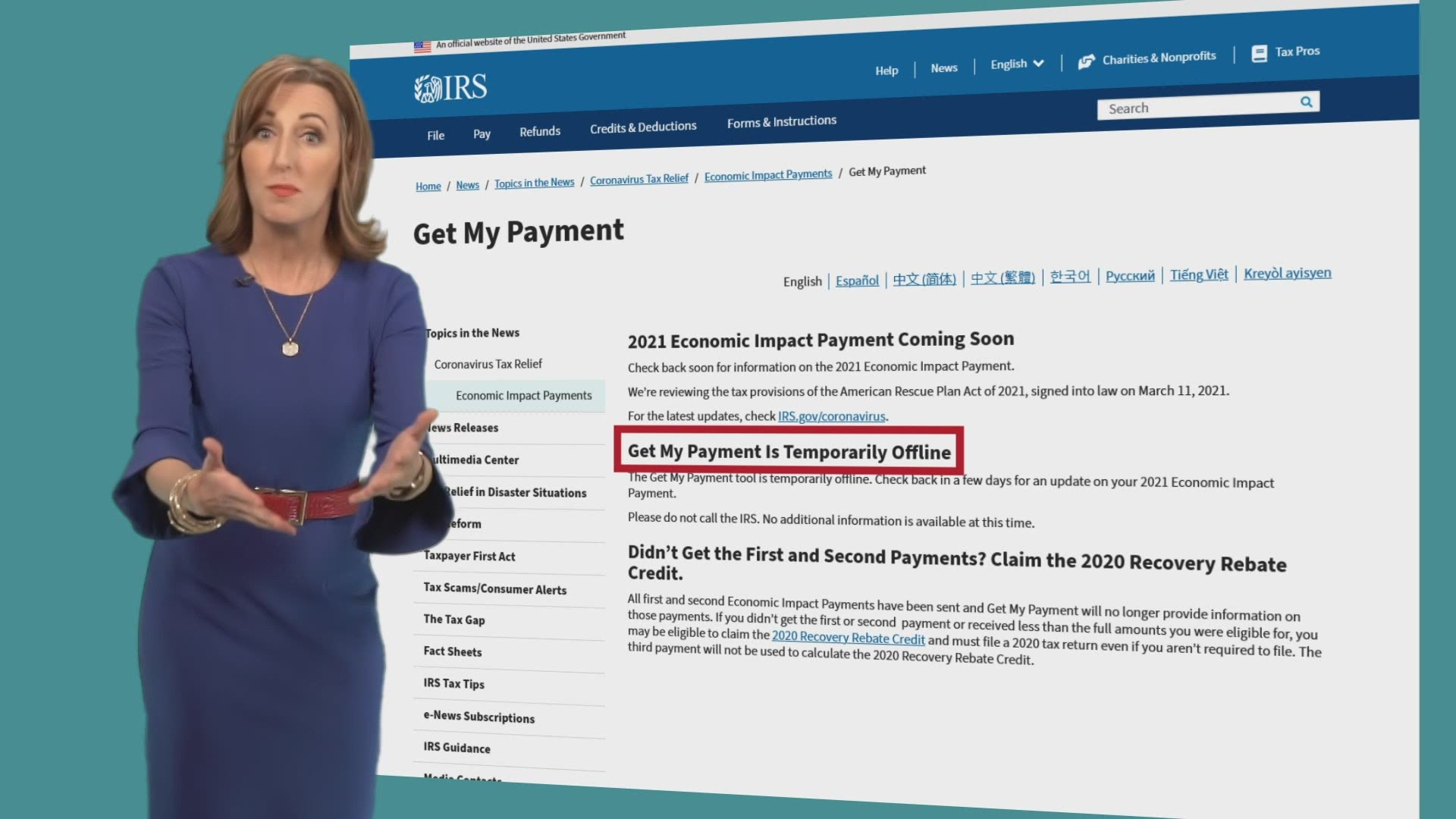

Here’s what to do: Visit the Get My Payment webpage and click on the blue button that says Get My Payment. The Internal Revenue Service mentioned they processed around 143 million tax returns in the current year. You can check the status of your stimulus money online using the Get My Payment tool provided by the IRS. However, due to the inconvenience, the IRS inaugurated a tool for all taxpayers who want to track their payments. It can take months to obtain your refund.

IRS.GOV STIMULUS CHECK TRACKING PATCH

To be the first to get news alerts with breaking stories in your town, or to get a free local newsletter each morning, sign up for Patch breaking news alerts or daily newsletters.Imagine that you pay your taxes earlier this year. Note: If you call the number, you'll have to listen. With reporting from Michael Woyton, Patch Staff. To request a payment trace, call the IRS at 80 or mail or fax a completed Form 3911, Taxpayer Statement Regarding Refund (PDF). Read more about checking your status here. Tax filers will also receive $600 for each dependent under age 17, and there's no cap on the number a household can receive, according to the Tax Foundation. Step 2: Click 'OK' on the authorized-use notification page after you've reviewed the terms. You can click on the given link below and directly get my payment page on the official website of the Internal Revenue Service. Get my payment Get my payment tool is the first way to track IRS stimulus payments. Click 'Get My Payment' to enter the portal. You can use the IRS stimulus tracker To track your payment.

IRS.GOV STIMULUS CHECK TRACKING FULL

Full payments will go to those who meet the following thresholds for adjusted gross income: $75,000 for single filers, $112,500 for heads of household, and $150,000 for those married filing jointly. Step 1: Got to the IRS Get My Payment app website. Treasurys Individual Income Tax (IIT) eService is a web platform used by the taxpayer to check refund status, view tax account information, ask questions. Most people who make under a certain amount will receive a non-taxable payment of $600. Access your stimulus payment with confidence. The IRS said the data is updated once per evening, overnight.įind out if you're eligible and how much you should receive, here: Stimulus Payments Coming: Calculate How Much You'll Get For more information, check with your local IRS office, state tax agency, tax professional, or the IRS website at IRS.gov/efile. Visit IRS.gov/EIP for more information on Economic Impact Payments. To use the link, one needs to enter a Social Security Number or TIN Number, as well as birthdate and address.Ĭheck the status of the first and second payments with the link here:

0 kommentar(er)

0 kommentar(er)